The long-awaited disruption

The coronavirus is inducing unpredicted effects and leading to a critical review of how the society will be, for setting the bases for the recovery and the prevention of future turbulences.

One example of the urgency for a significant change comes from the automotive industry. During decades, this sector played from a position of strength; now, it proves to be weaker than expected (sourcing issues, manufacturing interruptions, failing logistics, closure of dealer networks, new consumer behaviours). It’s time to innovate.

On the manufacturing side, changes can’t be as fast as we would like: the inertia caused by strong investments, legislation and regulations set what and how can be produced. Nonetheless, flexible approaches – at all levels – mitigate the “push the metal” effect for products with less demand and protect the profitability of operations, improving integration and quality from the source (ex.: new platforms can host an unprecedented variety of engine schemes).

Integration and interaction along the value chain don’t not mean necessarily a cost-cut effect, but also the ability of sharing know how to avoid mistakes and misleading shortcuts. An example: the complex supply chain and the dependence on long-distance supplies bring to a reconsideration of insourcing, reshoring, just in time; nonetheless, the concrete feasibility of “appealing” solutions depend on a closer analysis of many factors.

What about distribution networks? Regarding sales, the response to the crisis is different market by market, but a common feature is the potential adoption of public “recovery packages” (together with various incentive schemes) that follow well known paths. In the short run, they work, but for the long term the industry needs more: reading the change of the consumption paradigm, in addition to the technological one, leads to the introduction of flexible and effective solutions, decreasing the dependence on external help and stimulus packages.

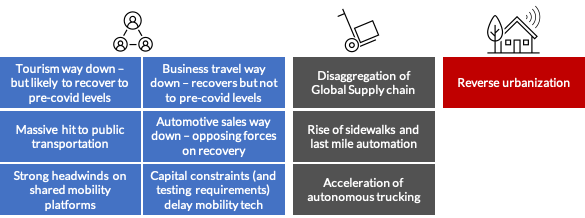

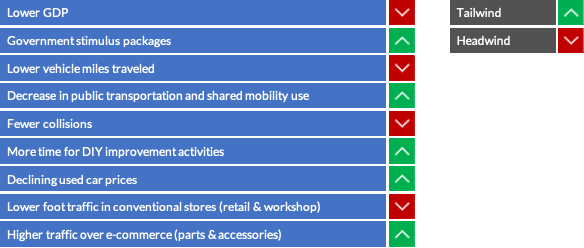

[9 impacts of Covid on the Future of Mobility, and 1 wild card; John Moavenzadeh for Casa SEAT, 2020]

There is a need of ideas, out of consolidated schemes, to achieve concrete results and higher proactivity, whereas the automotive sector sometimes acts reactively. The awareness and the ability of being “creative” will allow to build a long-lasting advantage.

Imagination and sense of urgency drive “traditional” players to explore new schemes for overcoming the current concept of dealer network without displacing it (ex.: VW and the VAPV dealer association agreed on a new distribution model in Germany for the all-electric ID. range) and manage sales under innovative umbrellas. On the service side, “contactless”, “no touch”, “remote”, “safe” are the words guiding the current development of new operational processes, while beyond the short term higher attention has to be posed on new service propositions, quality, loyalty, efficiency. This will protect and keep the territorial presence (advantageous position) and create new opportunities, without succumbing to the newcomers (not based on an expensive and complex background).

Strategies for service, parts and accessories depend on factors that spread their effect differently over the time, but that can also ease or affect the countercyclical features of the aftermarket.

[Beyond the coronavirus: the way ahead for the automotive aftermarket; McKinsey, 2020]

Automotive professionals must trigger and accompany the change, to let it permeate all layers of the value chain. This industry increasingly embraces the cross-contamination, more dynamically and stronger than ever: the way to the continuity starts from here, with an acceleration of the innovation cycle.

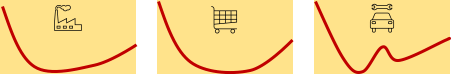

The shape of the recovery curve has an impact on short-term decisions, while the will to evolve and the ability of managing the change are independent from it. On the opposite, they have to be further motivated by the current conditions. Production, sales and service, most likely, will see a different pace in their evolution, the better strategies read this factor, the better focused they are.

The collective intelligence has to guide an “out of the box” thinking, because the situation is “out of the box”. In the Post-Covid 19 we’ll learn to put ourselves in discussion continuously, in view of new turbulences, not necessarily as painful as the current one. As far as manufacturers and networks will be able to listen to signals coming from increasingly evolved customers (empathy) and go beyond customer centric slogans, replacing them with behaviours– conscious and meaningful -they will also be able to build flexible strategies that grant legitimacy – the right – to be on the market. Not only that: profitability – at all levels – can grow and be “healthier” (how many pockets of inefficiency can be detected? When aftersales will be effectively converted in “pre-sales”?).

Cars are (still) deeply embedded in our lifestyle: mobility, flexibility, status symbol, jobs. For how long? How long the “New Normal” will last? When will it become “old”? We’ll realize soon that what we are living is the disruption that will bring an evolution the sector needed: as far as we’ll be prepared, the change will be a tool and not a threat.

Renzo Spacone

We are proud to have been invited by SDF Ibérica at the Annual Dealer Meeting of the Spanish network, designed to… Read more

Innovation, opportunities, future: AI is setting ever new standards that mean huge improvements for managing talent and innovation, but also big risks… Read more

The MWC Barcelona 2025 is about to start and within this framework Cámara de Comercio Italiana Barcelona (CCIB) organizes a special… Read more